Understanding Amortization: Your Complete Guide to Loan and Mortgage Schedules

Amortization is a vital financial concept for managing loans and intangible assets, helping you plan payments or allocate costs effectively. Whether you're buying a home, financing a car, or handling business finances, tools like an amortization schedule calculator can provide clarity and save money. This guide explains what amortization means, how it works for loans and accounting, and answers common questions like “what is amortization?” or “how to make an amortization schedule in Excel?” to empower your financial decisions. Note: This content is for informational purposes only. Consult a financial advisor for personalized advice.

What is Amortization?

Amortization refers to two key processes: spreading out loan payments over time or allocating the cost of intangible assets, like patents, trademarks, or goodwill, over their useful life. For loans, an amortization schedule details each payment’s principal and interest components, showing how your balance reduces. In accounting, amortization spreads the cost of assets like software or goodwill, impacting financial statements and tax obligations (Investopedia: Amortization).

For example, a $200,000 mortgage at 4% interest over 30 years has a monthly payment of $954.83. Early payments primarily cover interest, but over time, more goes toward the principal. Use a mortgage calculator with amortization to visualize this shift. Note: Common misspellings like “ammortization” or “amorization” refer to the same concept, and our tools can help regardless of how you search.

Why Amortization Schedules Matter

An amortization table calculator provides a detailed breakdown of loan payments, offering several benefits:

- Financial Planning: Track total interest paid with a loan amortization schedule calculator.

- Budgeting: Understand monthly commitments using a mortgage amortization schedule.

- Early Payoff: See how extra payments reduce interest and loan duration with a mortgage payoff calculator.

- Specialized Loans: Tools like a seller financing calculator or land contract calculator help with niche financing options.

For a $30,000 car loan at 5% over 5 years, a car loan amortization schedule shows monthly payments of $566.14, with $3,968.40 in total interest. Adding $100 monthly via a car loan calculator with extra payments could save $500 in interest and shorten the term by 6 months.

Sample Amortization Table

Here’s an example amortization chart for a $100,000 loan at 4% interest over 10 years:

| Month | Payment | Interest | Principal | Balance |

|---|---|---|---|---|

| 1 | $1,321.51 | $333.33 | $988.18 | $99,011.82 |

| 12 | $1,321.51 | $319.71 | $1,001.80 | $88,136.72 |

| 24 | $1,321.51 | $285.91 | $1,035.60 | $76,614.94 |

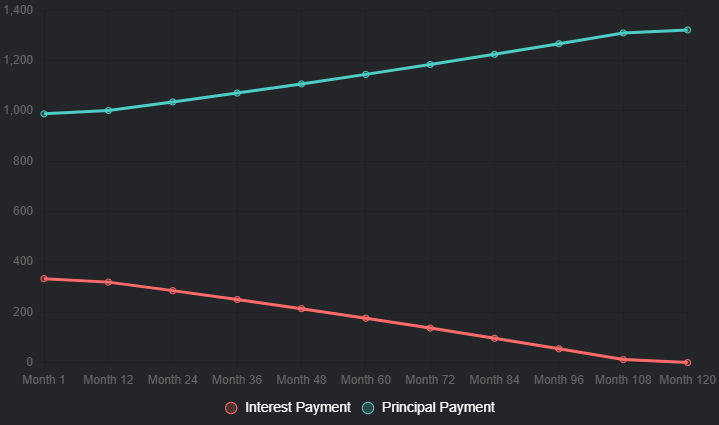

Visualizing Amortization

An amortization chart calculator can generate a graph showing the declining balance and the shift from interest to principal payments over time. Below is a chart for the $100,000 loan example, illustrating how interest payments decrease while principal payments increase:

- X-Axis: Month (1 to 120)

- Y-Axis: Payment Amount ($)

- Red Line: Interest Payment (e.g., $333.33 in Month 1, $11.91 in Month 108)

- Blue Line: Principal Payment (e.g., $988.18 in Month 1, $1,309.60 in Month 108)

This visual, paired with an amortization schedule chart , makes it easier to grasp long-term loan dynamics. Try our className="underline text-blue-500 hover:text-blue-700 transition-colors" amortization schedule calculator to create your own chart.

Types of Amortization Schedules

- Fixed Monthly Payment: Common for mortgages, with consistent payments, as seen in an amortization schedule with fixed monthly payment .

- Extra Payments: Additional principal payments lower interest costs, trackable with a loan calculator with extra payments.

- Balloon Payments: Lower initial payments with a large final payment, calculated using a balloon loan calculator.

- Interest-Only: Early payments cover only interest, analyzed via an interest only loan calculator.

Amortization Across Loan Types

Mortgage Amortization

A mortgage amortization schedule calculator is essential for homebuyers. For a $300,000 mortgage at 3.5% over 30 years, monthly payments are $1,347.13, with total interest of $184,968.80. A mortgage payment calculator with extra payments shows that an extra $200 monthly could save $30,000 in interest and shorten the term by 5 years.

Car Loan Amortization

A $25,000 car loan amortization at 6% over 4 years has monthly payments of $586.92. Using an auto loan calculator with extra payments, an extra $100 monthly reduces interest by $500 and pays off the loan 4 months faster.

Personal and Business Loans

For unsecured loans, a personal loan calculator or business loan calculator estimates payments. A $50,000 business loan at 7% over 5 years has payments of $990.06, per a loan amortization table calculator.

FHA and VA Loans

Specialized loans like FHA or VA require unique calculations. An FHA loan calculator accounts for mortgage insurance premiums (e.g., 0.85% annually), while a VA mortgage calculator includes funding fees (e.g., 2.3% for first-time use). These tools clarify costs for government-backed loans.

Seller Financing and Land Contracts

Niche financing options like seller financing or land contracts are common in real estate. A seller financing calculator or land contract calculator helps estimate payments for a $100,000 property at 5% over 10 years, with monthly payments of $1,321.51, similar to traditional loans but with flexible terms.

Amortization in Accounting

Amortization in accounting spreads the cost of intangible assets over their useful life, reducing taxable income. Examples include:

- Patents: A $20,000 patent over 10 years results in a $2,000 annual expense.

- Goodwill: After a business acquisition, goodwill amortization might allocate $50,000 over 15 years, yielding $3,333 annually.

- Trademarks: A $10,000 trademark over 5 years amortizes at $2,000 per year.

- Software: A $30,000 software license over 6 years amortizes at $5,000 annually.

These expenses lower taxable income, but tax rules vary. For example, goodwill amortization is deductible in the U.S. under IRS Section 197, but not in some countries like the UK (Patriot Software: Amortization in Accounting). Unlike depreciation, which applies to tangible assets like machinery (e.g., using accelerated methods), amortization typically uses the straight-line method for intangibles. For a detailed comparison, see our amortization vs depreciation guide.

Amortization Formula Explained

The amortization formula calculator uses this formula for loan payments:

Payment = P * [r(1+r)^n] / [(1+r)^n - 1]

Where:

- P = Principal (loan amount)

- r = Monthly interest rate (annual rate ÷ 12)

- n = Number of payments

For a $10,000 loan at 6% over 3 years:

- P = $10,000

- r = 0.06 ÷ 12 = 0.005

- n = 36

- Payment = $10,000 * [0.005(1+0.005)^36] / [(1+0.005)^36 - 1] ≈ $304.22

For Excel users, the PMT, IPMT, and PPMT functions simplify this.

Common Amortization Questions

Based on popular searches like “what is amortization” (8,100 searches), “amortization definition” (6,600 searches), and “what is an amortized loan” (2,900 searches), here are answers to frequent questions:

- What is amortization? It means gradually paying off a loan or spreading an asset’s cost over time, reducing the principal or book value systematically.

- What is an amortized loan? A loan where payments are spread over time, covering both principal and interest, as shown in an amortization schedule loan.

- What’s the difference between amortization and depreciation? Amortization applies to intangible assets (e.g., patents, goodwill amortization ), while depreciation covers tangible assets (e.g., vehicles). Amortization uses the straight-line method; depreciation may use accelerated methods (IRS: Depreciation).

- How do I create an amortization schedule in Excel? Use the PMT function for payments, IPMT for interest, and PPMT for principal. Our loan payment schedule excelguide offers a template.

- Can extra payments save money? Yes, extra payments reduce principal, lowering total interest. A loan calculator with extra payments quantifies these savings.

- What are seller-financed loans? Loans where the seller acts as the lender, common in real estate. Use a seller finance calculator to estimate payments.

Tools to Simplify Amortization

Our calculators streamline financial planning:

- Amortization calculator schedule: Build detailed schedules.

- Mortgage calculator amortization table: Plan home loans.

- Auto loan calculator: Compare car financing options.

- HELOC calculator: Estimate home equity line payments.

- Debt-to-income calculator: Assess borrowing capacity.

- FHA loan calculator: Factor in mortgage insurance costs.

- VA mortgage calculator: Include funding fees.

- Seller financing calculator: Analyze niche real estate loans.

Tips for Managing Amortization

- Monitor Progress: Regularly review your amortization schedule loan.

- Add Extra Payments: Use a mortgage payoff calculator to plan early payoffs.

- Explore Tax Benefits: Mortgage interest and some amortization expenses (e.g., goodwill) may be deductible (IRS: Home Mortgage Interest Deduction).

- Compare Refinancing: A refinance calculator evaluates savings from new loan terms.

Conclusion

Amortization is essential for managing loans and intangible assets. Whether you’re exploring a mortgage amortization table, car loan amortization schedule calculator, or accounting for goodwill amortization, our tools like the amortization schedule calculator provide clarity. Share your questions below or try our loan calculator to start planning!