Guide to Mortgage Calculators: Estimate Payments and Save with Extras

Table of Contents

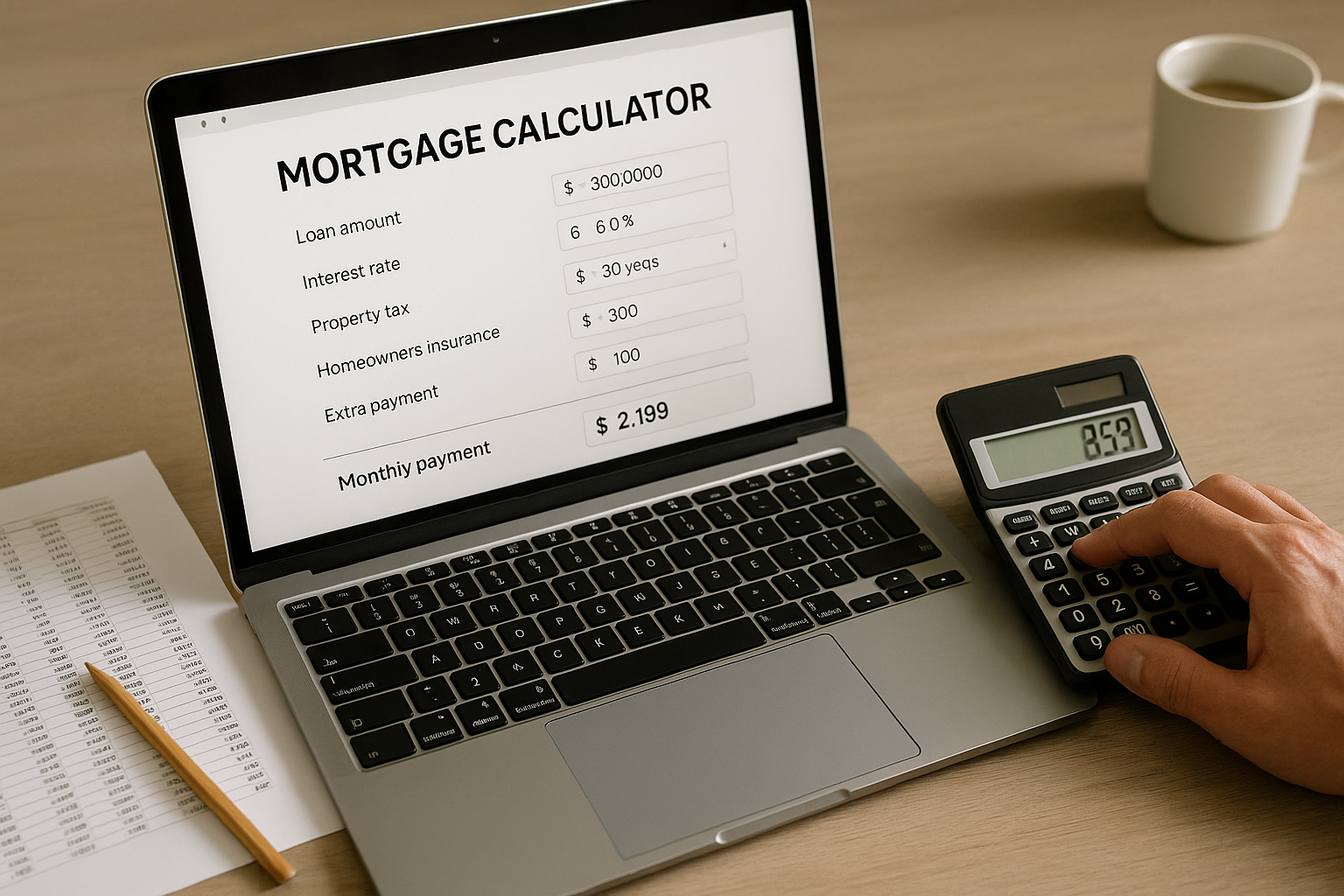

Buying a home is a major financial step, and understanding your mortgage payments is key. Tools like our mortgage calculator, monthly mortgage payment calculator, or amortization calculator can help you plan effectively. This guide explores how these tools work, how to estimate monthly payments, and the impact of extra payments on your mortgage. Let’s dive in!

Why Use a Mortgage Calculator?

A mortgage payment calculator simplifies complex calculations, helping you estimate your monthly mortgage payment based on loan amount, interest rate, and term. These tools also factor in costs like taxes, insurance, and PMI (private mortgage insurance), giving you a clear picture of your total house payment.

Using a free mortgage calculator or online mortgage payment calculator, you can:

- ✓Estimate monthly mortgage payments with precision.

- ✓Explore how extra payments reduce interest and shorten loan terms.

- ✓Calculate costs including property tax and homeowners insurance.

- ✓Plan your budget with confidence using a mortgage payment estimator.

Mortgage calculators simplify homeownership planning. Try our mortgage calculator to get started.

Key Features of a Mortgage Payment Calculator

A simple mortgage calculator offers basic estimates, while advanced tools like a mortgage calculator with taxes and insurance provide comprehensive insights. Here’s what you can calculate:

Monthly Mortgage Payment

Input your loan amount, interest rate, and loan term into a monthly payment calculator mortgage to get your base payment. For example, a $300,000 loan at 6% interest over 30 years yields a monthly principal and interest payment of about $1,799.

Taxes and Insurance

A mortgage payment calculator with taxes and insurance includes property tax and homeowners insurance. These vary by location but can add $200–$500 monthly to your house payment.

Private Mortgage Insurance (PMI)

If your down payment is less than 20%, you may need PMI. A mortgage calculator with PMI estimates this cost, typically 0.5–1% of the loan amount annually.

Down Payment Impact

A home affordability calculator shows how a larger down payment lowers your loan amount and monthly payments. For instance, a 10% vs. 20% down payment on a $400,000 home can save you hundreds monthly.

Amortization Schedules

An amortization calculator breaks down each payment into principal and interest, showing how your balance decreases over time. This is critical for understanding your mortgage loan amortization.

Extra Payments

A mortgage payoff calculator reveals how additional principal payments reduce interest and shorten your loan term. For example, paying an extra $100 monthly on a $300,000 loan could save thousands in interest and cut years off your mortgage.

How to Use a Mortgage Calculator Effectively

Follow these steps to make the most of a house payment calculator or mortgage calculator monthly payment tool:

Gather Key Information

Loan amount (home price minus down payment), interest rate, loan term (e.g., 15, 20, or 30 years), estimated property tax and homeowners insurance rates, and PMI rate, if applicable.

Input Data into a Calculator

Use a free mortgage payment calculator or best mortgage calculator for accurate results. Tools like an amortization calculator or mortgage calculator with taxes and insurance provide detailed breakdowns.

Analyze the Results

Review your estimated monthly mortgage payment, including taxes, insurance, and PMI. Check the amortization schedule to see how payments evolve over time.

Experiment with Extra Payments

Use a mortgage payoff calculator to see how paying more on your mortgage affects your loan. For example, a paying off home loan early calculator can show savings from biweekly payments or lump-sum contributions.

Compare Scenarios

Adjust variables like down payment, loan term, or interest rate in a mortgage calculator to find the best option for your budget.

Maximize your planning with our mortgage calculator and mortgage payoff calculator.

Benefits of Making Extra Mortgage Payments

Using a mortgage payoff calculator, you can see the long-term benefits of paying extra:

- ✓Lower Total Interest: Extra payments reduce the principal, cutting interest costs significantly.

- ✓Shorter Loan Term: A mortgage payoff calculator shows how additional payments can shave years off your mortgage.

- ✓Faster Equity Building: Paying down your loan faster with a mortgage payoff calculator increases your home equity sooner.

For example, on a $250,000 loan at 5% interest over 30 years, adding $200 monthly could save over $60,000 in interest and shorten the loan by nearly 8 years.

See how extra payments save you money with our mortgage payoff calculator.

Choosing the Best Mortgage Calculator

With so many options, finding the right tool is key. Here are some top picks:

| Calculator Type | Best For |

|---|---|

| Mortgage Calculator | Quick estimates of monthly mortgage payments |

| Mortgage Calculator with Taxes and Insurance | Comprehensive house payment estimates |

| Amortization Calculator | Understanding long-term payment schedules |

| Mortgage Payoff Calculator | Planning early payoff strategies |

| Home Affordability Calculator | Estimating upfront costs and their impact |

Look for a free mortgage calculator with a user-friendly interface and detailed outputs. A mortgage calculator tailored to your region ensures accuracy.

Common Mistakes to Avoid

- •Ignoring Taxes and Insurance: Always use a mortgage calculator with taxes and insurance to avoid underestimating costs.

- •Overlooking PMI: If your down payment is low, factor in PMI with a mortgage calculator with PMI.

- •Not Accounting for Extra Payments: Use a mortgage payoff calculator to see potential savings.

- •Using Outdated Rates: Ensure your mortgage calculation reflects current market rates.

- •Skipping Amortization Details: An amortization calculator helps you understand how payments reduce your balance over time.

Avoid costly mistakes by using our mortgage calculator and amortization calculator.

Conclusion

A mortgage calculator is an essential tool for anyone navigating homeownership. Whether you’re using a monthly mortgage payment calculator, house payment calculator with taxes and insurance, or amortization calculator, these tools empower you to make informed financial decisions. By estimating your monthly house payment, exploring extra payment options, and understanding costs like PMI and property tax, you can save money and achieve your homeownership goals faster.

Ready to start? Try our free mortgage calculator today to calculate your mortgage payment and see how paying off your home loan early can transform your financial future. Share your favorite calculator or tips in the comments below!